Statement of reasons—Expiry review determination: Sucker rods (SR 2023 ER)

Concerning an expiry review determination under paragraph 76.03(7)(a) of the Special Import Measures Act Special Import Measures Act certain sucker rods originating in or exported from China.

Decision

Ottawa,

On March 14, 2024, pursuant to paragraph 76.03(7)(a) of the Special Import Measures Act, the Canada Border Services Agency determined that the expiry of the finding made by the Canadian International Trade Tribunal on December 14, 2018, in Inquiry No. NQ-2018-001:

- is likely to result in the continuation or resumption of dumping of certain sucker rods originating in or exported from China; and

- is likely to result in the continuation or resumption of subsidizing of certain sucker rods originating in or exported from China

On this page

Executive summary

[1] On October 16, 2023, the Canadian International Trade Tribunal (CITT), pursuant to subsection 76.03(1) of the Special Import Measures Act (SIMA), gave notice that it will initiate an expiry review of its finding made on December 14, 2018, in inquiry NQ-2018-001, concerning the dumping and subsidizing of certain sucker rods (subject goods) originating in or exported from the People’s Republic of China (China).

[2] As a result of the CITT’s notice of expiry review, on October 17, 2023, the Canada Border Services Agency (CBSA) initiated an expiry review investigation to determine, pursuant to paragraph 76.03(7)(a) of SIMA, whether the expiry of the finding is likely to result in the continuation or resumption of dumping and/or subsidizing of the subject goods from China.

[3] The CBSA received a response to the Canadian producer expiry review questionnaire (ERQ) from Apergy Canada ULC doing business as Alberta Oil Tool (AOT)Footnote 1. The submission made by AOT included information supporting their position that continued or resumed dumping and subsidizing, of subject goods from China is likely if the CITT’s finding expires.

[4] The CBSA received a response to the importer ERQ from AOTFootnote 2, Weatherford Canada Ltd. (Weatherford Canada)Footnote 3 and Tenaris Global Services (Canada) Inc. (TECA)Footnote 4. The submission made by TECA included information supporting their position that continued or resumed dumping and subsidizing of subject goods from China is likely if the CITT’s finding expires.

[5] The CBSA received a response to the exporter ERQ from Zibo Hongyang Weatherford Oilfield Equipment Co., Ltd. (Zibo Weatherford)Footnote 5. The CBSA did not receive a response to the foreign government ERQ from the Government of China (GOC).

[6] It should be noted that Weatherford Canada and Zibo Weatherford are related parties.Footnote 6

[7] AOT provided case briefs to the CBSA in support of their position that continued or resumed dumping and subsidizing of subject goods from China is likely if the CITT’s finding expires.Footnote 7 No other party provided a case brief to the CBSA and no party provided a reply submission in response to the case brief submitted by AOT.

[8] Analysis of information on the administrative record indicates a likelihood of continued or resumed dumping into Canada of subject goods originating in or exported from China should the CITT’s finding expire. This analysis relied upon the following factors:

- Chinese exporters are selling at low and potentially dumped prices in other markets and well below Canadian import prices;

- Chinese exporters’ inability to compete at non-dumped prices and continued interest in the Canadian market;

- Chinese producers of sucker rods have significant production capacity and are export oriented; and

- Anti-dumping measures in place in Canada and in other jurisdictions concerning steel goods from China used in the production of oil and gas.

[9] In addition, analysis of information on the administrative record indicates a likelihood of continued or resumed subsidizing of subject goods from China should the CITT’s finding expire. This analysis relied upon the following factors:

- Continued availability of subsidy programs for sucker rod exporters in China;

- Countervailing measures against China steel products used in the production of oil and gas in Canada and in the United States.

[10] For the forgoing reasons, the CBSA, having considered the relevant information on the record, determined on March 14, 2024, pursuant to paragraph 76.03(7)(a) of SIMA, that the expiry of the finding in respect of sucker rods:

- is likely to result in the continuation or resumption of dumping of the goods from China; and

- is likely to result in the continuation or resumption of subsidizing of the goods from China.

Background

[11] On May 18, 2018, following a complaint filed by AOT, the CBSA initiated an investigation pursuant to subsection 31(1) of SIMA regarding the dumping and subsidizing of subject goods from China.Footnote 8

[12] On November 14, 2018, the CBSA made final determinations of dumping and subsidizing, in accordance with paragraph 41(1)(b) of SIMA, in respect of subject goods from China.Footnote 9

[13] On December 14, 2018, the CITT found, pursuant to subsection 43(1) of SIMA in inquiry NQ-2018-001, that the dumping and subsidizing of subject goods from China had caused injury to the domestic industry. The CITT’s Statement of reasons for the finding on certain sucker rods was issued on December 31, 2018.Footnote 10

[14] On October 16, 2023, the CITT, pursuant to subsection 76.03(1) of SIMA, initiated an expiry review of its finding made on December 14, 2018, in inquiry NQ-2018-001.Footnote 11

[15] On October 17, 2023, the CBSA initiated an expiry review investigation to determine whether the expiry of the finding is likely to result in the continuation or resumption of dumping and/or subsidizing of certain sucker rods from China.

Product definition

[16] The goods subject to this expiry review investigation are defined as:

Additional product information

[17] Sucker rods are used in oil and gas extraction. In an oil or gas well, the rod string connects the above-ground drive to the down well pump(s). They are usually produced to 25 feet in length but can be longer.

[18] Pony rods are shorter lengths of sucker rods used to obtain the proper length of rod string when a full sucker rod would make the string too long. Pony rods are connected to each other, or to sucker rods, with couplings. They are usually produced in lengths of 1, 2, 4, 6, 8, 10 or 12 feet. Pony rods are usually made in the same diameters as sucker rods in the rod string.

[19] Sucker rods are “semi-finished” at any point following the forming of the ends of the material input (i.e. solid bar) into the essential sucker rod shape (e.g. forging) which typically creates the pin shoulder, wrench square and transition/upset of the sucker rod.

[20] The diameter of the sucker rod always refers to the outer diameter of the rod body, rather than any part of the forged end.

[21] Special grades of steel referred to in the product definition includes steel grades which may not meet standard industry specifications including proprietary grades.

[22] For greater clarify, the product definition does not cover:

- Polished rods, which are above ground connections to the rod strings;

- Sinker bars, which are used to add weight to the rod string;

- Fiberglass sucker rods (Fiber reinforced plastic);

- Hollow sucker rods; and

- Continuous sucker rods

[23] A “polished rod” connects the rest of the rod string to the above-ground drive. A polished rod is a special rod required to endure exposure to the surface conditions, unlike sucker rods which remain below ground the entire time they are being used. The polished rod’s placement requires particular sizing and characteristics which make it quite different from a sucker rod.

[24] A “sinker bar” is at the opposite end from the polished rod, as it connects the sucker rod string to the pump. The bar provides weight so that the tool will lower properly into the well.

[25] A fiberglass sucker rod or pony rod is typically manufactured in three pieces and assembled by a process that connects two metal end-fittings to a non-metallic fiber reinforced plastic rod body.

[26] A hollow sucker rod is made of seamless steel pipe, and the screw thread joint is connected with the rod body through friction welding and heat treatment. Hollow sucker rod is used for the exploitation of heavy oil, high freezing point oil and waxy crude oil. The hollow rod presents the ability to inject diluents through the hollow rod in progressive cavity pumping (PCP) operations.

[27] Continuous (coiled) sucker rods have an entire rod string in one piece with only two connections; one at the top and one at the bottom. These rods are available in either round or elliptical configurations. Continuous rod eliminates all the couplings along the entire wellbore except for the top connection to the polished rod and the bottom connection to the pump itself.

Classification of imports

[28] The subject goods are normally imported into Canada under the following tariff classification numbers:

- 8413.91.00.10

These tariff classification numbers may also include non-subject goods, and subject goods may also fall under additional tariff classification numbers.

Period of review

[29] The period of review (POR) for the CBSA’s expiry review investigation is January 1, 2020 to September 30, 2023.

Canadian industry

[30] The Canadian industry is comprised of the Apergy Canada ULC – Alberta Oil Tool Division (AOT), the sole producer of sucker rods in Canada.

[31] AOT produces and markets production service equipment solutions for the oil and gas industry. Products are produced under the “Norris” brand. Norris was founded in 1882. In addition to sucker rods and their accessory products, AOT produces pup joints, tubing and casing fittings, butterfly valves and controls.Footnote 12

[32] In June 2020, AOT’s parent company, Apergy Corporation, merged with ChampionX Holding Inc., the former upstream energy business of Ecolab Inc. As a result, Apergy ULC’s ultimate parent company is now ChampionX Corporation. The production and sale of sucker rods in Canada has been unaffected by the merger.Footnote 13

[33] AOT reported that its production of sucker rods is unchanged since the original investigation. AOT has one production facility in Edmonton that is used primarily for production of sucker rods.Footnote 14

[34] In addition to its production in Canada, AOT also imported sucker rods from the United States (U.S.) during the POR.Footnote 15

Canadian market

[35] The Canadian production and the apparent market for sucker rods cannot be disclosed as the total value and volume of Canadian production of sucker rods during the POR was based on confidential information filed by the sole Canadian sucker rods producer (i.e., AOT). The imports of sucker rods from China and all other countries are presented in Table 1 and Table 2 below.

| Source | 2020 | 2021 | 2022 | 2023 Jan – Sept |

|---|---|---|---|---|

| China | 1,652 | 73,967 | 325,572 | 238,205 |

| All other countries | 15,073,905 | 23,074,065 | 22,314,300 | 10,712,911 |

| Total imports | 15,075,557 | 23,148,032 | 22,639,872 | 10,951,116 |

| Source | 2020 | 2021 | 2022 | 2023 Jan – Sept |

|---|---|---|---|---|

| China | 20 | 995 | 4,726 | 2,331 |

| All other countries | 278,074 | 364,277 | 252,346 | 108,227 |

| Total imports | 278,094 | 365,272 | 257,072 | 110,558 |

Canadian production

[36] Canadian sucker rods production sold in the domestic market rose each year of the POR and is on trend for an annualized increase again in 2023. In terms of market share, the like goods sold from Canadian production has seen a significant increase throughout the POR, and the market share growth has continued throughout the first three quarters of 2023. Over the course of the POR, the total apparent Canadian market grew substantially in both 2021 and 2022, before an annualized decline in 2023 which was still higher than the total market in 2021.

Imports

[37] As seen in Tables 1 and 2, the imports of subject goods from China increased substantially from 2020 to 2022, before a slight annualized decline in 2023. Despite the substantial increase in imports of subject goods from China since 2020, Chinese imports of subject goods in terms of both value and quantity, represented less than one percent as a percentage of the apparent Canadian market throughout the entire POR. The data also shows that the import volumes of sucker rods from all other countries increased significantly from 2020 to 2021, before a decline in 2022 below levels seen in 2020 and a further annualized decline in 2023.

Enforcement data

[38] In the enforcement of the CITT’s finding during the POR, as detailed in Table 3 below, the CBSA assessed a total amount of anti-dumping and countervailing duties of $286,374 on imports of subject goods from China. The total value for duty of subject imports during the POR from China was $639,396. As a percentage of the total value for duty, the combined anti-dumping and countervailing duties assessed during the POR equaled to 44.8%.

| 2020 | 2021 | 2022 | Jan – Sept 2023 |

|

|---|---|---|---|---|

| Quantity | 20 | 995 | 4,726 | 2,331 |

| Value for duty | 1,652 | 73,967 | 325,572 | 238,205 |

| SIMA duties | 23 | 1,770 | 183,575 | 101,006 |

Parties to the proceedings

[39] On October 17, 2023, the CBSA sent notices concerning the initiation of the expiry review investigation and ERQs to the known Canadian producer, importers and exporters. The GOC was also sent a foreign government ERQ relating to subsidy.

[40] The ERQs requested information relevant to the CBSA’s consideration of the expiry review factors, as listed in subsection 37.2(1) of the Special Import Measures Regulations (SIMR).

[41] Three Canadian importers (the Canadian producer also acted as an importer), one Canadian producer and one foreign exporter participated in the expiry review investigation by responding to the ERQs.

[42] The Canadian producer, AOT, provided a case briefFootnote 19 to the CBSA in support of their position that continued or resumed dumping and subsidizing of subject goods from China is likely if the CITT’s finding expires.

[43] No other party provided a case brief or reply submission.

[44] The GOC did not provide a response to the CBSA’s ERQ nor did it submit a case brief or reply submission.

Information considered by the CBSA

Administrative record

[45] The information considered by the CBSA for purposes of this expiry review investigation is contained in the administrative record. The administrative record includes the information on the CBSA’s exhibit listing, which is comprised of the CBSA exhibits and information submitted by interested parties, including information which the interested parties feel is relevant to the decision as to whether dumping and subsidizing are likely to continue or resume absent the CITT finding. This information may consist of expert analysts’ reports, excerpts from trade publications and news articles, orders and findings issued by authorities of Canada or of a country other than Canada, documents from international trade organizations such as the World Trade Organization (WTO) and responses to the ERQs submitted by Canadian producers, exporters, importers and governments.

[46] For purposes of an expiry review investigation, the CBSA sets a date after which no new information submitted by interested parties will be placed on the administrative record or considered as part of the CBSA’s investigation. This is referred to as the “closing of the record date” and is set to allow participants time to prepare their case briefs and reply submissions based on the information that is on the administrative record as of the closing of the record date. For this investigation, the administrative record closed on December 6, 2023.

Position of the parties: Dumping

Parties contending that continued or resumed dumping is likely

[47] AOT and TECA made representations through their ERQ responses, in addition, AOT provided case briefs in support of their position that the dumping of subject goods from China is likely to continue or resume should the CITT’s finding expire. Consequently, AOT argued that the anti-dumping measures should remain in place.

[48] The main factors identified by AOT can be summarized as follows:

- Inability of Chinese sucker rod exporters to compete in the Canadian market at undumped prices;

- The Chinese sucker rods industry is export oriented and has significant and growing excess capacity;

- Demand for Chinese subject goods in key markets outside of North America is not likely to increase significantly in the next 12 to 24 months;

- The importance and the attractiveness of the Canadian market for the Chinese sucker rods industry.

Inability of Chinese sucker rod exporters to compete in the Canadian market at undumped prices

[49] AOT stated that Chinese imports of subject goods were essentially precluded from entering the Canadian market since the finding has been in place and even though some Chinese imports have returned to the Canadian market in recent years, the volumes remain a small fraction compared to the volumes prior to the finding. Consequently, the volume of imports entering the Canadian market has only occurred as normal values became increasingly outdated.Footnote 20

[50] It was indicated that at the beginning of the POR, imports of subject goods from China represented a mere 0.01% of the total imports into the Canadian market. This was a significant reduction as imports of subject goods from China represented 47.6% of total imports into Canada during the original investigation’s POI. AOT argued that this considerable reduction of imports is indicative of the effectiveness of the finding and the inability of Chinese subject goods to compete in the Canadian market at undumped prices.Footnote 21

[51] Furthermore, AOT contends that while there were increasing, albeit small volumes of subject goods imported into the Canadian market in recent years, the amount of SIMA duties assessed on these volumes were significant and likely understated given the outdated normal values.Footnote 22

[52] AOT demonstrated that SIMA duties paid from January 2022 to September 2023 were significant as they represented more than 50% of the value of goods imported during that period. In addition, AOT indicated that with the increasing material costs associated with the production of sucker rods since the finding, normal values has become increasingly outdated. Therefore, if normal values were up to date, the dumping experienced during this period would have translated into even more SIMA duties.Footnote 23

The Chinese sucker rods industry is export oriented and has significant and growing excess capacity

[53] AOT contends that Chinese producers of sucker rods have significant and growing excess capacity, and they have the capacity to flood the Canadian market. These producers are also export oriented and have established channels of distribution in the Canadian market.

[54] AOT found that there are 36 Chinese producers with active licenses to produce API-11B grade sucker rods based on the API Composite List. Of these 36 Chinese producers with active licenses, the 12 producers that publicly list their production capacity of sucker rods show a combined capacity of up to 12.92 million pieces.Footnote 24

[55] In general, demand for sucker rods is higher in a market when the production and demand for oil is high. AOT asserts that oil production in China is forecasted to decline in future years and this slowdown in oil production will likely translate to lower demand for domestic sucker rods. TECA had estimated that the domestic demand for Chinese sucker rods is substantially lower than their production capacity, therefore, as demand in China for sucker rods decline, this will further increase the excess capacity of Chinese producers.Footnote 25

[56] In light of soft demand in the Chinese market for sucker rods, AOT provided export data from IHS Markit and UN Comtrade to demonstrate the current and growing export orientation of Chinese sucker rod manufacturers. Based on the data, AOT contends that Chinese exports of goods under HS code 8413.91 have increased significantly both in terms of value and volume between 2018 and 2022. Furthermore, several Chinese producers of sucker rods have publicly listed Canada or the North American market in marketing materials as export destinations.Footnote 26

[57] Furthermore, AOT highlighted that many of the Chinese sucker rod producers have established channels of distribution in the Canadian market. In particular, Zibo Weatherford and Shandong Nine-Ring Petroleum Machinery Co., Ltd. (Nine-Ring) who were issued company-specific normal values in the original investigation, both continue to have an affiliated importer in Canada. AOT also identified two other Chinese manufacturers of sucker rods with known ties to the Canadian market.Footnote 27

[58] AOT concluded from the information on the record that as the demand in China softens for sucker rods and excess capacity continues to grow, Chinese producers will use their established channels of distribution in the Canadian market to significantly increase its imports of unfairly traded sucker rods should the finding be permitted to expire.

Demand for Chinese subject goods in key markets outside of North America is not likely to increase significantly in the next 12 to 24 months

[59] AOT stated that the global energy market is forecasted to stabilize and remain at the current muted level for the rest of 2023 and 2024. Given the demand and price for sucker rods are directly tied to the health of the oil industry, the overall global demand for sucker rods will likely remain muted as well.

[60] Citing information on the record, AOT summarized the extent of the global energy market as follows:Footnote 28

[61] Furthermore, AOT cited the NYMEX future markets for WTI which indicated that the price per barrel was trending towards under US$80 in 2024.Footnote 30

[62] AOT argued that “China’s demand for oil and gas, thus for sucker rods, is particularly vulnerable… China experienced a relatively weak economic recovery following its Zero-COVID policies that lasted until the end of 2022. This economic fragility is compounded by other problems, including weak export demand and the slowdown in its real-estate sector.”Footnote 31 Given these weak economic conditions, the demand for oil and gas in China are also expected to decelerate.

[63] To support this forecasted market softening, AOT summarized an International Energy Agency (IEA) report which stated that China’s consumption of oil is expected to:

[64] Furthermore, with respect to oil demand forecast, the IEA expects oil production in non-Organization for Economic Co-operation and Development (OECD) “Other Asia” markets to decrease from 2 mb/d in 2023 to 1.9 mb/d in 2024 and 2025.Footnote 33

[65] With respect to Europe, AOT stated that the Euro Area GDP growth is forecasted to fall from 5.3 percent in 2021 to 3.5 percent in 2022 and to a mere 0.7 percent in 2023, before recovering to just 1.2 percent in 2024. The muted economic outlook does not suggest strong demand for oil and gas, nor demand for sucker rods.Footnote 34

[66] AOT stated that oil production in Europe has been on a decline and is forecasted to remain stagnant. In particular, due to the Ukraine-Russia conflict, Europe has changed it’s approach to energy procurement and now seeks to secure supplies from friendly countries, notably including Canada, and through massive expansion of renewable energy under the Renewable Energy Directive. According to the Organization of the Petroleum Exporting Countries’ (OPEC) October 2023 forecast, European oil production will increase only slightly from a low point in 2021 to 3.58 mb/d in 2022, to 3.67 mb/d in 2023 and to 3.79 mb/d in 2024.Footnote 35

[67] AOT concluded from the recent developments in Europe that oil and gas exploration activities that drive sucker rods demand is not likely to increase in Europe in the near future. Rather, Europe’s shift in conventional energy sources away from Russia to friendlier sources will likely spur more activities in North America, including in Canada.Footnote 36

[68] AOT also highlighted market conditions in the Middle East and Central Asia referencing a report from the IEA that projects oil supply from countries such as Saudi Arabia, United Arab Emirates, Iraq, Kazakhstan, and Azerbaijan to remain stagnant until 2025. In addition, AOT noted that the region is also facing heightened uncertainties due to geopolitical tensions and should the war in Israel and Gaza spread further into a regional conflict, it could disrupt oil supplies and lead to further volatility in the global energy market.Footnote 37

[69] Lastly, AOT contended that the U.S. is the world’s largest producer of oil which would naturally make it one of the largest consumers of oil field products such as sucker rods. Consequently, since geopolitical conflicts in Ukraine-Russia and in the Middle East have raised energy security concerns among many major economies, the U.S. market is expected to benefit from the current conditions and grow in the next 12 to 24 months.Footnote 38

[70] AOT argued that due to the ongoing geopolitical conflicts, the U.S. and Canada have become attractive sources of global energy supply. According to an IEA report, the U.S. is expected to increase oil production from 17.85 mb/d in 2022 to 18.97 mb/d in 2023, 19.41 mb/d in 2024, and 19.75 mb/d in 2025. This stands in contrast to the oil supply projections in OPEC and non-OECD countries which are expected to decrease.Footnote 39

[71] In light of the positive market forecast for the U.S., Chinese exporters are in a particularly challenging position to participate in the growth of the U.S. market due to trade barriers. In particular, Chinese imports of steel products into the U.S. are subject to 25 percent duties under Section 301 of the U.S. Trade Act of 1974. AOT noted that the trade restrictive impact of Section 301 duties is evident based on the records evidence as Chinese export volumes to the U.S. under HS Code 8413.91 has been on a downward trend from 2018 to the end of the POR.Footnote 40

[72] AOT concluded from the information on the record that due to the demand for Chinese subject goods in key markets outside of North America is not likely to increase significantly in the next 12 to 24 months, and the trade restrictive impact of Section 301 in the U.S., the continued or resumed dumping of subject goods is likely should the finding be rescinded.

The importance and the attractiveness of the Canadian market for the Chinese sucker rods industry

[73] It was stated that Canada is an important market for sucker rods because it is a major oil and gas producer, therefore, a major source of demand for sucker rods. AOT argued that pricing in Canada is relatively higher than pricing in other markets, especially when compared to markets with no protection against unfair imports, making Canada particularly attractive.Footnote 41

[74] The primary factor for the attraction to the Canadian market is the oil production itself, which drives demand for sucker rods and which AOT noted is substantial:

[75] AOT noted that Canada was ranked China’s third largest export destination in 2017 by value under HS Code 8413.91 and since the finding, Canada has not fallen below the eighth place.Footnote 43

[76] In terms of the present market conditions, AOT stated that the Canadian market is expected to improve relative to other markets. AOT references a Canadian Association of Energy Contractors (CAOEC) report indicating that wells drilled in Canada in 2022 was 5,723, which represents an increase of 23% over 2021. The report also indicated that drilling in Canada will increase by 12% in 2023 with 6,180 wells expected to be completed. Furthermore, the demand for Canadian oil and gas is expected to continue to grow due to the geopolitical conditions in other regions as previously discussed above.Footnote 44

[77] As previously discussed, AOT again cited the Chinese exporters established channels of distribution in Canada indicating that they remain interested in the Canadian market and are well positioned to take advantage of the established networks and quickly increase imports when opportunities appear.Footnote 45

[78] AOT concluded that the record evidence shows that Chinese sucker rod producers and exporters are facing muted demand in China and other export markets, as well as trade restrictive measures in the United State, therefore, Canada will be an attractive market for subject goods which makes the continuation and resumption of dumping likely if the finding is allowed to expire.

Parties contending that continued or resumed dumping is unlikely

[79] No parties contended that continued or resumed dumping of certain sucker rods from China is unlikely should the finding expire.

Consideration and analysis: Dumping

[80] In making a determination under paragraph 76.03(7)(a) of SIMA as to whether the expiry of the findings is likely to result in the continuation or resumption of dumping of the goods, the CBSA may consider the factors identified in subsection 37.2(1) of the SIMR, as well as any other factors relevant under the circumstances.

[81] Guided by these aforementioned factors, the CBSA conducted its review based on the documentation submitted by the various participants and its own research, all of which can be found on the administrative record. The following list represents a summary of the CBSA’s analysis conducted in this expiry review investigation with respect to dumping:

- Chinese exporters are selling at low and potentially dumped prices in other markets and well below Canadian import prices;

- Chinese exporters’ inability to compete at non-dumped prices and continued interest in the Canadian market;

- Chinese producers of sucker rods have significant production capacity and are export oriented; and

- Anti-dumping measures in place in Canada and in other jurisdictions concerning steel goods from China used in the production of oil and gas.

Chinese exporters are selling at low and potentially dumped prices in other markets and well below Canadian import prices

[82] In reviewing the information available on the administrative record, the information suggests that exports of sucker rods from China to other markets in recent periods could be below domestic selling prices in China, making them potentially dumped prices.

[83] Of the known and potential exporters of subject goods, Zibo Weatherford was the only exporter to provide a complete response to the CBSA’s ERQ. In it’s submission, Zibo Weatherford provided the CBSA with data pertaining to their total volume and value of sales of certain sucker rods during the POR. Based on the data provided by Zibo Weatherford, it appears that sales have been made at potentially dumped prices in other markets and well below Canadian import prices.

[84] In examining the pricing information provided by Zibo Weatherford, it appears that in certain periods during the POR Chinese export prices were below those of the domestic market in China. In 2021, the average unit value to the multiple markets were less than the average unit value of Chinese domestic sales. Again in 2022 and 2023 (Jan-Sept), the average unit value for export sales to certain countries were less than the reported Chinese domestic value. This suggests that Chinese sucker rods sold to export markets may have been dumped during the POR.Footnote 46

[85] In light of the information above, during the original investigation the CBSA made a determination that the conditions of paragraph 20(1)(a) of SIMA exist in the steel oil and gas products sector in China, which includes sucker rods. In the opinion of the CBSA, the GOC substantially determines the domestic prices of sucker rods and there is sufficient reason to believe that the domestic prices are not substantially the same as they would be in a competitive market.Footnote 47 As such, the domestic Chinese prices reported by Zibo Weatherford may be understated due to the GOC’s influence in the steel oil and gas products sector.

[86] Considering the fact that Zibo Weatherford’s domestic selling prices are potentially understated, the CBSA compared the average unit value of sucker rods imported into Canada during the POR to the average unit value of sales reported by Zibo Weatherford to other export markets.

[87] In comparing the annual average unit value of total imports of certain sucker rods into Canada during the POR to the average unit value of Zibo Weatherford’s total export sales, the annual average unit value of Zibo Weatherford’s total export sales remains well below the average unit value of total Canadian imports during the entire POR. This suggest that Chinese sucker rod prices to other export markets may have been dumped during the most recent period in which there is pricing information on the administrative record.Footnote 48

[88] Based on the average unit value analysis above, information suggests that Chinese export prices are well below recent Canadian import prices and that Chinese exporters are selling at low and potentially dumped prices in other markets. In the event that the current finding were to expire, it is likely that sucker rods exported from China to Canada would be at substantially lower prices than current imports into Canada and that those prices would likely be dumped.

Chinese exporters’ inability to compete at non-dumped prices and continued interest in the Canadian market

[89] As noted by AOT and supported by CBSA import statistics, imports of subject goods into Canada since the finding and during the POR have essentially been non-existent. The Canadian producer contended that this was due to Chinese sucker rod exporters inability to compete in the Canadian market at undumped prices.

[90] During the original investigation, three Chinese exporters fully cooperated with the CBSA’s investigation and received normal values. The Statement of reasons explains that normal values were determined in accordance with subparagraph 20(1)(c)(i) of SIMA using the profitable domestic sales of like goods of producers in the surrogate countries (United States and Romania). In the absence of like goods, normal values could not be determined in accordance with paragraphs 20(1)(c) or 20(1)(d) of SIMA due to insufficient information. As a result, in absence of sufficient like goods information under paragraph 20(1)(c) of SIMA, normal values were determined pursuant to a ministerial specification in accordance with subsection 29(1) of SIMA using domestic sales of the closest matching products in the surrogate countries, taking into consideration all relevant characteristics such as grade, length, coupling types and underlying mechanical and chemical properties of the input steel bar.Footnote 49

[91] In light of cooperative Chinese exporters having normal values based on market pricing, there has been sharp decline of subject goods from China since the finding has been in place. During the original investigation’s POI (January 1, 2017 to March 31, 2018) imports of certain sucker rods from China represented 59.7% of total imports with respect to volume.Footnote 50 Based on the data presented previously in Table 2, during the POR, Chinese import volumes as a percentage of total import volumes were only 0.01%, 0.27%, 1.84% and 2.11% during 2020, 2021, 2022 and 2023 (January – September) respectively.

[92] Despite there being negligible volumes of subject imports since the imposition of the finding, in recent periods there has been a slight increase of subject imports from China. Although the increase in volumes are minimal, imports have been returning to the Canadian market over the course of the POR as normal values have become increasingly outdated.

[93] In examining recent pricing information published by MB Fastmarkets for special bar quality (SBQ) in the U.S., there have been significant increases to raw material costs for sucker rods between November 2018 and September 2023. Since normal values were issued in November 2018, the price of SBQ 1-inch round 1,000 series and SBQ 1-inch round 4,000 series FOB mill U.S. have both seen more than a 30% increase when compared to September 2023, the end of the POR.Footnote 51

[94] At the beginning of the POR in January 2020, SBQ pricing had decreased by over 20% since November 2018 when normal values were issued. At this time, CBSA import data indicated that only 20 pieces of sucker rods were imported into Canada from China. However, at the start of 2022, SBQ pricing had increased by over 35% when compared to November 2018 pricing.Footnote 52 During 2022, the CBSA import data reported 4,726 pieces of sucker rods imported from China representing a 235% increase. Although volumes of imports of subject goods remained well below levels prior to the finding, as normal values become understated due to increasing raw material cost, Chinese exporters appear ready to resume sales to Canada as normal values become increasingly outdated.

[95] Based on the information above, the negligible volumes of subject imports seen since the finding demonstrates that Chinese exporters are unable to compete in Canada with normal values based on market pricing. Furthermore, with the increase in sucker rod’s raw material costs, coupled with normal values remaining at their 2018 levels, Chinese exporters are becoming increasingly interested in resuming sales to Canada at very low and potentially dumped prices. In the event the current finding were to expire, it is likely that subject goods exported from China to Canada would increase as Chinese exporters continue to show interest in the Canadian market despite not being able to compete at non-dumped prices.

Chinese producers of sucker rods have significant production capacity and are export oriented

[96] While information regarding the apparent demand in the Chinese market for sucker rods is limited, information on the administrative record shows that Chinese producers of sucker rods have significant production capacity while being export oriented.

[97] According to AOT’s market intelligence, there are 36 Chinese producers with active licenses to produce API-11B grade sucker rods based on the API Composite List and of these 36 producers, 12 publicly list their production capacity of sucker rods showing a combined capacity of up to 12.92 million pieces.Footnote 53 For 2022, the CBSA has estimated the size of the Canadian market to be less than 5% of potential Chinese production capacity.Footnote 54

[98] Furthermore, the CBSA estimates that Chinese sucker rod producers that had normal values during the POR have a combined production capacity of over 5.5 million pieces of sucker rods. The production capacity of Chinese sucker rod producers with active normal values vastly exceeds the size of the Canadian market estimated by the CBSA, resulting in Chinese sucker rod producers having sufficient production capacity to supply the Canadian market many times over.

[99] Despite the significant production capacity in China, the CBSA was unable to reliably estimate the apparent demand in the Chinese market for sucker rods based on information on the administrative record. Therefore, the CBSA cannot accurately determine whether the significant production capacity in China translates to significant excess capacity. However, Zibo Weatherford, the only Chinese exporter of sucker rods who provided a response to the CBSA’s ERQ, provided figures with respect to their annual production capacity for sucker rods along with its additional capacity for other products on common equipment.Footnote 55

[100] Zibo Weatherford also reported capacity utilization rates for the combined production of sucker rods and other products produced on common equipment for the years 2022, 2021, 2022 and 2023 (January to September).Footnote 56 Based on the figures provided, Zibo Weatherford had available significant excess capacity in comparison to the total apparent Canadian market during the entire POR. Should the finding be rescinded, Zibo Weatherford alone would have the excess capacity to increase production and exports to the Canadian market.

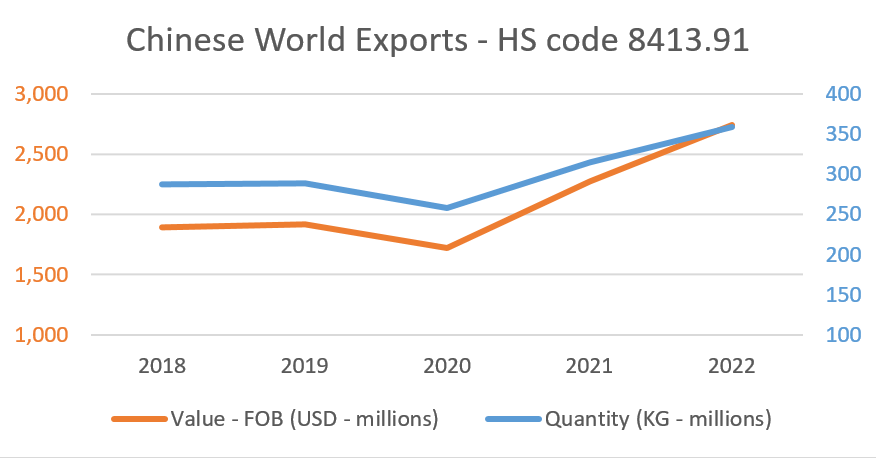

[101] In addition to the significant production capacity, based on data on the administrative record, the export orientation of Chinese sucker rod producers has appeared to be growing over the course of the POR. As mentioned in the classification of imports section, subject goods are normally imported into Canada under tariff classification number 8413.91.00.10. According to UN Comtrade data, Chinese exports of goods under HS code 8413.91Footnote 57 have increased both in terms of value and volume between 2018 and 2022 as seen in the chart below.

Text description: Chinese World Exports—HS code 8413.91

| Year | Value - FOB (USD - millions) | Quantity (KG - millions) |

|---|---|---|

| 2018 | 1,896 | 287 |

| 2019 | 1,915 | 288 |

| 2020 | 1,718 | 257 |

| 2021 | 2,276 | 314 |

| 2022 | 2,743 | 358 |

[102] In terms of value, since 2018 when the finding has been in place, the FOB value of goods under HS code 8413.91 exported from China increased from 1,897 million USD to 2,743 million USD in 2022, representing an increase of 44.6%. In terms of volume, UN Comtrade data reported an increase from 287 million kg exports in 2018 to 359 million kg in 2022, representing an increase of 24.9%.Footnote 58

[103] Further to the export orientation of Chinese producers of sucker rods, a number of companies have publicly listed Canada or the North American market in marketing materials as one of their export destinations. The following is a list of companies that publicly list Canada or North America as export destinations for sucker rods or have been known exporters to Canada in the past:

- Baotou Liande Oil and Mechanical Co., Ltd.Footnote 59

- Found Petroleum Equipment Co. Ltd.Footnote 60

- Jack Artificial Lift Machinery Co., Ltd.Footnote 61

- Shandong Nine-Ring Petroleum Machinery Co., Ltd.Footnote 62

- Shandong Shouguang Kunlong Petroleum Machinery Co., Ltd.Footnote 63

- Zibo WeatherfordFootnote 64

[104] As noted earlier by AOT, Chinese sucker rod producers also have established channels of distribution in the Canadian market. In particular, Zibo Weatherford and Nine-Ring, Chinese sucker rod producers with company-specific normal values, both continue to have an affiliated importer in Canada. Furthermore, other Chinese manufacturers of sucker rods have been identified as having ties to the Canadian market, including Shengyang PetroChina Tianbao (Group) Materials and Equipment Co. Ltd., which is a subsidiary company of China’s largest oil company China National Petroleum Corporation (CNPC)Footnote 65, and Jack Artificial Lift Machinery Co., Ltd., a Chinese base company of Schlumberger which operates several locations in Canada.Footnote 66

[105] Based on the information above, it is apparent that China has significant production capacity to produce sucker rods and producers are becoming more export dependent in order to maintain and increase capacity utilization rates. In the event that the finding were to expire, Chinese produced sucker rods could be used to easily supply the entire Canadian market as exporters return to their established channels of distribution and experience of selling to the North American market.

Anti-dumping measures in place in Canada and in other jurisdictions concerning steel goods from China used in the production of oil and gas

[106] It was stated in the CITT’s injury finding that “sucker rods are commodity products used for oil and gas extraction…. As such, demand for sucker rods, as well as price, is directly tied to the health of the oil industry. If oil production drops so does the demand for sucker rods”.Footnote 67

[107] In addition to sucker rod measures, the CBSA currently has five anti-dumping measures in place against other Chinese steel products that are involved in oil and gas production: Oil Country Tubular Goods, Seamless Casing, Pup Joints, Line Pipe, and Large Line Pipe.Footnote 68

[108] Information on the administrative record also indicates that the U.S. has four anti-dumping measures against steel products from China used in the production of oil and gas. The products that are subject to the U.S. anti-dumping measures include: Oil Country Tubular Goods, Large Diameter Welded Pipe, Certain Seamless Carbon and Alloy Steel Standard Line and Pressure Pipe, and Circular Welded Carbon Quality Steel Line Pipe.Footnote 69

[109] Further to these measures in Canada and the U.S., information on the administrative record indicates that there are numerous anti-dumping measures in place in other jurisdictions against steel tubular products from China used in the production of oil and gas. Table 7 below summarizes those anti-dumping measures:

| Country | Description of goods |

|---|---|

| Brazil | Seamless tubes |

| Brazil | Line pipe for oil and gas pipelines of seamless iron or steel |

| Brazil | Line pipe up to 5” |

| Columbia | Line pipe |

| Columbia | Casing or tubing |

| European Union | Seamless pipes and tubes (AD632) |

| European Union | Welded tubes and pipes of iron or non-alloy steel (AD523) |

| Mexico | Welded pipes and tubes |

| Mexico | Seamless line pipe between 2” to 4” |

| Mexico | Seamless line pipe from 5” to 16” |

| Russia | Seamless OCTG |

| Thailand | Iron and steel tubes and pipes |

| Turkey | Seamless tubes and pipes of iron and steel |

| United Kingdom | Welded tubes and pipes |

[110] The above-mentioned measures in Canada and the many anti-dumping measures in other jurisdictions against Chinese steel products used in oil and gas production demonstrates that Chinese exporters have a propensity to dump these products into Canada and other export markets. In absence of the CITT’s finding, this pattern of behaviour will likely result in the continuation of, or resumed dumping by Chinese sucker rod exporters.

Determination regarding likelihood of continued or resumed dumping

[111] Based on the information on the record in respect of the: Chinese exporters selling at low and potentially dumped prices in other markets and well below Canadian import prices; Chinese exporters’ inability to compete at non-dumped prices and continued interest in the Canadian market; Chinese producers of sucker rods having significant production capacity and being export oriented; and anti-dumping measures in place in Canada and in other jurisdictions concerning steel goods from China used in the production of oil and gas, the CBSA has determined that the expiry of the finding is likely to result in the continuation or resumption of dumping of certain sucker rods from China.

Position of the parties: Subsidizing

Parties contending that continued or resumed subsidizing is likely

[112] AOT and TECA made representations through their ERQ responses, in addition, AOT provided case briefs in support of their position that the subsidizing of certain sucker rods from China is likely to continue or resume should the CITT’s finding expire. Consequently, AOT argued that the countervailing measures should remain in place.

[113] It was noted that the CBSA identified seven subsidy programs from which responding exporters had benefited from during the POI of the original investigation. AOT contended that the CBSA found that Chinese exporters had also benefited from trade-distorting, prohibited subsidies. AOT cited information provided by Zibo Weatherford in the original investigation that indicated that grants were issued to exporters if their export sales exceeded a certain level set by local authorities to support China’s “Going Global” strategy.Footnote 71

[114] AOT cited the CBSA’s wind towers investigation that concluded on November 2, 2023, noting that the subsidy programs investigated during the sucker rods investigation were investigated again as part of wind towers from China. The results of the wind towers investigation demonstrated that six of the seven subsidy programs that were countervailed during the original sucker rods investigation have remained in force during the wind tower investigation’s POI of April 1, 2021 to March 31, 2023.Footnote 72

[115] With reference to the GOC notification to the WTO, AOT noted:

[116] AOT further noted that there are other Chinese API-11B licensed sucker rod producers that are awarded the “high-tech” designation. Such companies include: Shandong Molong; Shandong Highland Oil and Gas Equipment; and CGE Zhangjiakou Exploration Machinery. AOT also identified other company’s that are known to be state-owned enterprises that could be benefiting from subsidies through less transparent means.Footnote 74

[117] AOT concluded that the record evidence demonstrates that Chinese sucker rod producers have long benefited from various countervailable subsidies, including trade distorting, prohibited export subsidies, and that they will likely continue to be subsidized in the next 12 to 24 months.

Parties contending that continued or resumed subsidizing is unlikely

[118] No parties contended that continued or resumed subsidizing of subject goods from China is unlikely if the finding expires.

Consideration and analysis: Subsidizing

[119] In making a determination under paragraph 76.03(7)(a) of SIMA as to whether the expiry of the finding is likely to result in the continuation or resumption of subsidizing of the goods, the CBSA may consider the factors identified in subsection 37.2(1) of the SIMR, as well as any other factors relevant under the circumstances.

[120] Guided by the aforementioned regulations and having examined the information on the administrative record, the following is a list of the factors considered in the analysis with respect to the likelihood of continued or resumed subsidizing:

- The continued availability of subsidy programs for sucker rod exporters in China;

- The countervailing measures against China steel products used in the production of oil and gas in Canada and in the U.S..

The continued availability of subsidy programs for sucker rod exporters in China

[121] In consideration of the lack of participation from Chinese producers and exporters of sucker rods and the GOC in this expiry review, the CBSA relied on information from the original investigation and pertinent information on the record in assessing the likelihood of continued or resumed subsidization, should the CITT’s finding expire.

[122] At the time of the CBSA’s original investigation in 2018, the CBSA identified 22 subsidy programs and found that 7 of the 22 identified programs had conferred benefits to the cooperative exporters. The identified programs that had conferred a benefit to the exporters are as follows:Footnote 75

- Design, research and development grants;

- Export performance grants;

- Corporate income tax reduction for new high tech enterprises;

- Municipal/local income or property tax reductions;

- Preferential tax policies related to research and investment;

- Exemption or refund of tariff and import value-added tax (VAT) for imported technologies and equipment; and

- Acquisition of government assets/inputs at less than fair market value.

[123] The amounts of subsidy for all cooperative exporters ranged from 5.81 to 31.21 Renminbi (RMB) per piece. The amount of subsidy for all other exporters was determined to be equal to 119.54 RMB per piece, as determined according to a Ministerial specification pursuant to subsection 30.4(2) of SIMA.Footnote 76

[124] On October 18, 2023, the CBSA made a final determination subsidizing with respect to wind towers from China. During the wind tower investigation, the CBSA again investigated the same seven subsidy programs that had conferred a benefit to cooperative exporters during the sucker rods investigation. Of those seven programs, six were determined to be continuously available and used by exporters during the POI of the wind tower investigation between April 1, 2021 to March 31, 2023.Footnote 77

[125] Although the CBSA has not had participation from the GOC in recent subsidy proceedings, the GOC has made recent notifications to the WTO of its subsidy programs, including one in July 2023. The extensive list of subsidies disclosed by the GOC included 69 subsidies at the central government level in various forms, with a particular focus on preferential tax treatments, including one for preferential tax treatment for oil and natural gas production enterprises.Footnote 78

[126] Consequently, the record is clear that since the final determination of the original investigation and throughout the period of review, the GOC has made subsidy programs available to producers/exporters of sucker rods in China.

The countervailing measures against China steel products used in the production of oil and gas in Canada and in the U.S.

[127] In addition to sucker rod measures, the CBSA currently has five countervailing measures in place against Chinese steel product enterprises involved in oil and gas production: Oil Country Tubular Goods, Seamless Casing, Pup Joints, Line Pipe, and Large Line Pipe.Footnote 79

[128] Information on the administrative record also indicates that the U.S. has four countervailing measures against steel products from China used in the production of oil and gas. The products that are subject to the U.S. countervailing measures include: Oil Country Tubular Goods, Large Diameter Welded Pipe, Certain Seamless Carbon and Alloy Steel Standard Line and Pressure Pipe, and Circular Welded Carbon Quality Steel Line Pipe.Footnote 80

[129] The existence of nine countervailing measures in place in Canada and in the U.S. concerning steel products from China used in the oil and gas industry indicates that Chinese exporters/producers of sucker rods receive countervailable benefits from the GOC and that the GOC has placed a great deal of importance on its steel products associated with the oil and gas industry and subsidized it accordingly. The consistent subsidizing of sucker rods throughout the POR and back to the original investigation support the position that the GOC will likely continue to subsidize its domestic sucker rod producers in the future.

Determination regarding likelihood of continued or resumed subsidizing

[130] Based on the information on the record in respect of: the continued availability of subsidy programs for sucker rod exporters in China; and the countervailing measures against China steel products used in the production of oil and gas in Canada and in the U.S., the CBSA has determined that the expiry of finding is likely to result in the continuation or resumption of subsidizing of subject goods from China.

Conclusion

[131] For the purpose of making a determination in this expiry review investigation, the CBSA conducted its analysis within the scope of the factors found under subsection 37.2(1) of the SIMR and considering any other factors relevant in the circumstances. Based on the foregoing consideration of pertinent factors and analysis of information on the record, on March 14, 2024, the CBSA made a determination pursuant to paragraph 76.03(7)(a) of SIMA that the expiry of the finding made by the CITT on December 14, 2018, in inquiry NQ-2018-001 in respect of certain sucker rods originating in or exported from China:

- is likely to result in the continuation or resumption of dumping of the goods from China; and

- is likely to result in the continuation or resumption of subsidizing of the goods from China.

Future action

[132] On March 15, 2024, the CITT initiated its expiry review to determine whether the continued or resumed dumping and subsidizing are likely to result in injury. The CITT’s expiry review schedule indicates that it will make its decision by August 21, 2024.

[133] If the CITT determines that the expiry of the finding with respect to the goods is likely to result in injury, the finding will be continued in respect of those goods, with or without amendment. If this is the case, the CBSA will continue to levy anti-dumping and/or countervailing duties on dumped and/or subsidized importations of the subject goods.

[134] If the CITT determines that the expiry of the finding with respect to the goods is not likely to result in injury, the finding will be rescinded in respect of those goods. Anti-dumping and/or countervailing duties would then no longer be levied on importations of the subject goods, and any anti-dumping and/or countervailing duties paid in respect of goods that were released after the date that the finding was scheduled to expire will be returned to the importer.

Contact us

[135] For further information, please contact the officers listed below:

- Telephone:

- Aaron Maidment: 343-553-1633

- Gabriella Mondor: 343-597-2795

Doug Band

Director General

Trade and Anti-dumping Programs Directorate

- Date modified: