Statement of Reasons—Expiry Review Determination: Liquid dielectric transformers (TR 2023 ER)

Concerning an expiry review determination under paragraph 76.03(7)(a) of the Special Import Measures Act respecting certain liquid dielectric transformers originating in or exported from the Republic of Korea.

Decision

Ottawa,

On , pursuant to paragraph 76.03(7)(a) of the Special Import Measures Act, the Canada Border Services Agency determined that the expiry of the Canadian International Trade Tribunal's order made on , in expiry review RR-2017-002, is likely to result in the continuation or resumption of dumping of certain liquid dielectric transformers originating in or exported from the Republic of Korea.

On this page

Executive summary

[1] On , the Canadian International Trade Tribunal (CITT), pursuant to subsection 76.03(1) of the Special Import Measures Act (SIMA), initiated an expiry review of its order made on , in Expiry Review No. RR 2017-002, concerning the dumping of certain liquid dielectric transformers (large power transformers) originating in or exported from the Republic of Korea (Korea).

[2] As a result of the CITT's notice of expiry review, the Canada Border Services Agency (CBSA), on , initiated an investigation to determine, pursuant to paragraph 76.03(7)(a) of SIMA, whether the expiry of the order is likely to result in the continuation or resumption of dumping of the goods to Canada.

[3] The CBSA received responses to its Expiry Review Questionnaire (ERQ) from Hitachi Energy Canada Inc. (Hitachi Energy)Footnote 1, Transformateurs Delta Star Inc. (Delta Star)Footnote 2, Northern Transformers Corp. (NTC)Footnote 3 and PTI Transformers LP. (PTI)Footnote 4, all producers of liquid dielectric transformers in Canada. Submissions made by Hitachi Energy, Delta Star, Northern Transformer and PTI included information supporting their position that the continued or resumed dumping of certain power transformers from Korea is likely if the CITT's order is rescinded.

[4] The CBSA received responses to its ERQ from the following Canadian importers of power transformers: Hyundai Electric America Corporation (HE America)Footnote 5 and Hyundai Canada Inc. (Hyundai Canada)Footnote 6 . Both of these importers purchase their product from HD Hyundai Electric Co. Ltd. (Hyundai Electric). None of these importers directly expressed an opinion on the likelihood of continued or resumed dumping of subject goods in their ERQ responses.

[5] The CBSA received a response to its ERQ from one exporter of subject goods: HD Hyundai Electric Co. Ltd. (Hyundai Electric)Footnote 7. Hyundai Electric & Energy Systems Co., Ltd. changed its name to HD Hyundai Electric Co. Ltd. on . Hyundai Electric is a new company created from Hyundai Heavy Industries in . Hyundai Electric did not directly express an opinion on the likelihood of continued or resumed dumping of subject goods in their ERQ response.

[6] The CBSA received a case brief on behalf of Hitachi Energy, PTI and Delta Star (LPT Coalition)Footnote 8. No reply submissions were filed.

[7] The analysis of the information on the record indicates that Korean producers are export oriented, which is likely to continue in the future; Korean exporters are facing declining sales for power transformers and weak future demand for power transformers in their home market; Korean producers/exporters have excess production capacity; there is increased competitive price pressure on sales of large power transformers in Canada; anti dumping measures in other countries demonstrate that Korean exporters have a propensity to dump large power transformers; measures taken by the United States are likely to cause a diversion of dumped goods into Canada; and the largest exporter in Korea has continued to dump subject goods into Canada during the period of review (POR).

[8] As a result, the CBSA made a determination under paragraph 76.03(7)(a) of SIMA that the expiry of the order in respect of the dumping of large power transformers originating in or exported from Korea is likely to result in the continuation or resumption of dumping of the goods into Canada.

Background

[9] On , following a complaint filed by ABB and CG Power Systems Canada Inc. (now known as PTI), the CBSA initiated an investigation pursuant to subsection 31(1) of SIMA into the dumping of large power transformers originating in or exported from Korea.

[10] On , the CBSA made a final determination of dumping, pursuant to subsection 41(1) of SIMA, in respect of large power transformers originating in or exported from Korea.

[11] On , the CITT found pursuant to subsection 43(1) of SIMA that injury had been caused by the dumping of the goods originating in or exported from Korea. The CITT's Statement of Reasons for the finding was issued on .Footnote 9

[12] On , an application for judicial review of the CBSA's final determination of dumping was made to the Federal Court of Appeal (FCA) by Hyundai Heavy Industries Co. Ltd., one of the parties to the investigation. On , the FCA issued a decision that set aside the CBSA's final determination of dumping and referred the matter back to the CBSA for reconsideration in accordance with the Court's reasons.

[13] On , the CBSA made a new final determination of dumping, pursuant to subsection 41.1(1) of SIMA, in respect of large power transformers originating in or exported from Korea, which stemmed from the decision of the FCA made on .

[14] On , the CITT decided to conduct an interim review on its own initiative in order to determine if its finding of injury should be continued, with or without amendment, or rescinded in light of the new facts, i.e. the reduced margins of dumping in the CBSA's new final determination of dumping.

[15] On , an application for judicial review of the President's new final determination was filed to the FCA by the Canadian manufacturers of large power transformers. On , an application for judicial review was also filed to the FCA by Hyundai Heavy Industries Co. Ltd. and Hyundai Canada. The applications were heard consecutively at the FCA and on , the FCA dismissed the applications.

[16] On , the CITT issued an order, pursuant to paragraph 76.01(5)(a) of SIMA, continuing without amendment its finding of injury.

[17] On , the CBSA concluded a re-investigation to update the normal values and export prices of large power transformers originating in or exported from Korea. Both Hyosung Corporation (Hyosung) and Hyundai Electric & Energy Systems (HEES) participated in the re-investigation and specific normal values for shipments on or after of large power transformers to Canada were determined based on updated information provided by these two cooperative exporters.

[18] On , the CITT issued an order, pursuant to paragraph 76.03(12)(b) of SIMA, continuing without amendment its finding of injury.

[19] On , the CBSA commenced an expiry review investigation to determine whether the expiry of the order is likely to result in continued or resumed dumping of the goods from Korea. The CBSA was required to make a determination no later than .

Product definition

[20] The goods subject to the order under review are defined as:

Liquid dielectric transformers having a top power handling capacity equal to or exceeding 60,000 kilovolt amperes (60 megavolt amperes), whether assembled or unassembled, complete or incomplete, originating in or exported from the Republic of Korea.

Additional product information can be found in Appendix A.

Classification of imports

[21] Beginning , under the revised customs tariff schedule, subject goods are normally classified under the following tariff classification numbers:

- 8504.23.00.00 – Liquid dielectric transformers, having a power handling capacity exceeding 59,000 kVA but not exceeding 100,000 kVA

- 8504.23.00.30 – Liquid dielectric transformers, having a power handling a power handling capacity exceeding 100,000 kVA

[22] Unassembled or incomplete power transformers may also be imported under the following 10 digit Harmonized System classification numbers:

- 8504.90.90.10 – Parts - Printed circuit assemblies, of electric transformers and other inductors, other, of electric transformers

- 8504.90.90.82 – Parts - Having a power handling capacity of 500 kVA or more

- 8504.90.90.90 – Parts – Other

Period of review

[23] The period of review (POR) for the CBSA's expiry review investigation is to .

Canadian industry

[24] The Canadian industry for large power transformers is currently comprised of Hitachi Energy, Delta Star, NTC and PTI.

Hitachi Energy

[25] Hitachi Energy produces power transformers at its plant located in Varennes, Québec, which was constructed in 1970 and officially opened in 1971. Hitachi Energy's precursor in Canada, ABB Inc., began producing power transformers in 1972. In 2018, ABB global announced that it was selling an 80.1 percent stake in its power grids operations to Hitachi Ltd., resulting in the formation in of a joint venture initially named Hitachi ABB Power Grids, and subsequently renamed Hitachi Energy Ltd in 2021. As of 2022, Hitachi Ltd. acquired the remaining stake in the joint venture from ABB global. In addition to power transformers Hitachi Energy also produces shunt reactors and high voltage direct current transformers for converter stations at the Varennes plant. Hitachi's workforce is represented by Syndicat des travailleurs et travailleuses de Hitachi-Québec (CSN).

Delta Star

[26] Delta Star is a producer of a full range of power transformers located in Saint Jean sur Richelieu, Quebec. It purchased the facility from Alstom Grid Inc. in 2015. Delta Star's parent company, which owns 100% of the Canadian company, is based in Lynchburg, Virginia, United States. The Canadian facility has been producing large power transformers since 2008.

NTC

[27] NTC was founded in 1981 and owns and operates a production facility in Maple, Ontario, capable of producing liquid filled transformers up to 240 kV and approximately 200 MVA. NTC is a recent entrant to the large power transformer market and has had limited sales and production of transformers over 60 MVA.Footnote 10 NTC's workforce is represented by Unifor.

PTI

[28] PTI (formerly Partner Technologies Incorporated) was established in 1989 and grew through the acquisition of assets previously owned by CG Canada Inc. in . The company operates manufacturing facilities in Regina and Winnipeg. Production of like goods is concentrated within the Winnipeg facility which produces transformers up to 750 MVA and up to 500 kV. PTI also produces mobile substations, integrated substation solutions, and shunt reactors. PTI's workforce is represented by the United Steel Workers.

Associations

[29] There are no producer-only associations that represent manufacturers of power transformers in Canada. However, the Electro Federation of Canada, which represents more than 250 members across Canada, includes companies that manufacture, distribute, market and sell a wide range of electrical products including large power transformers.Footnote 11

Canadian market

[30] The apparent Canadian market for large power transformers during the POR is presented in Table 1 below. The CBSA cannot release specific quantitative data as it would lead to the disclosure of confidential information. As such information is presented in percentages only.

Table 1: Apparent Canadian market for the period of reviewFootnote 12

| Source | 2020 (%) | 2021 (%) | 2022 (%) | 2023-Jan (%) |

|---|---|---|---|---|

| Canadian production | 65.3 | 64.1 | 56.5 | 54.7 |

| Republic of Korea | 13.1 | 4.5 | 8.5 | 37.3 |

| All other countries | 21.6 | 31.4 | 35 | 8.0 |

| Total imports | 34.7 | 35.9 | 43.5 | 45.3 |

| Total CDN market | 100 | 100 | 100 | 100 |

| Source | 2020 (%) | 2021 (%) | 2022 (%) | 2023-Jan (%) |

|---|---|---|---|---|

| Canadian production | 51.8 | 49.2 | 44.0 | 30.0 |

| Republic of Korea | 22.4 | 21.3 | 12.0 | 60.0 |

| All other countries | 25.9 | 29.5 | 44.0 | 10.0 |

| Total imports | 48.2 | 50.8 | 56.0 | 70.0 |

| Total CDN market | 100 | 100 | 100 | 100 |

Canadian production

[31] Based on the figures presented in Table 1, the Canadian producers' share of the apparent Canadian market, in terms of the total dollar value, was 65.3% in 2020, 64.1 % in 2021, 56.5% in 2022, and 54.7% in . The Canadian producers' share of the apparent Canadian market, as a percentage of the total volume, was 51.8% in 2020, 49.2% in 2021, 44.0% in 2022, and 30.0% in . The data reveals that the Canadian producers' share of the apparent Canadian market underwent a moderate decline in 2022 which continued into .

Imports: Korea

[32] As seen in Table 1, during the POR, the total dollar value of the imports of subject goods from Korea as a percentage of the apparent Canadian market was 13.1% in 2020, 4.5% in 2021, 8.5% in 2022, and 37.3% in . The volume of imports from Korea as a percentage of the apparent Canadian market was 22.4% in 2020, 21.3% in 2021, 12.0% in 2022, and 60.0% in . The data indicates that the imports of subject goods from Korea decreased from 2020 to 2022, but increased based on the data from .

Imports: Other countries

[33] Also in Table 1, during the POR, the total dollar value of the imports of large power transformers from other countries (i.e., the non-named countries) as a percentage of the apparent Canadian market was 34.7% in 2020, 31.4% in 2021, 35.0% in 2022, and 8.0% in . The volume of imports from other countries as a percentage of the apparent Canadian market was 25.9% in 2020, 29.5% in 2021, 44.0% in 2022, and 10.0% in . In terms of value, the data shows that the imports of large power transformers from other countries increased from 2020 to 2022. In terms of volume, the data shows that the imports of large power transformers from other countries increased from 2020 to 2022. These imports originate in a number of countries, with the United States being a significant source during the POR.

Enforcement data

[34] As a result of the limited number of parties involved, detailed information regarding the value, volume and SIMA duties assessed on subject imports cannot be divulged for confidentiality reasons.

Parties to the proceedings

[35] On , the CBSA sent a notice concerning the initiation of the expiry review investigation and ERQs to the known Canadian producers, importers and exporters.

[36] The ERQs requested information needed to consider the expiry review factors, as found in subsection 37.2(1) of the Special Import Measures Regulations (SIMR), relevant to this expiry review investigation.

[37] Four Canadian producers HitachiFootnote 13, PTIFootnote 14, NTCFootnote 15 and Delta StarFootnote 16 participated in the expiry review investigation and responded to the ERQs. Two Canadian importers: HE AmericaFootnote 17 and Hyundai CanadaFootnote 18 and one exporter of subject goods: Hyundai ElectricFootnote 19 also participated in the expiry review investigation and provided ERQ responses.

[38] A Case brief was received on behalf of the LPT Coalition Footnote 20.

Information considered by the CBSA

Administrative record

[39] The information considered by the CBSA for purposes of this expiry review investigation is contained on the administrative record. The administrative record includes the exhibits listed on the CBSA's exhibit listing, which is comprised of the CBSA exhibits and information submitted by interested persons, including information which they feel is relevant to the decision as to whether dumping is likely to continue or resume, if the order is rescinded. This information may consist of expert analyst reports, excerpts from trade magazines and newspapers, orders and findings issued by authorities of Canada or of a country other than Canada, documents from international trade organizations such as the World Trade Organization and responses to the ERQs submitted by domestic producers, importers and exporters.

[40] For purposes of an expiry review investigation, the CBSA sets a date after which no new information submitted by interested parties may be placed on the administrative record or considered as part of the CBSA's investigation. This is referred to as the closing of the record date. This allows participants time to prepare their case briefs and reply submissions based on the information that is on the record as of the date the record closed. For this expiry review investigation, the record closed on .

Position of the parties

Parties contending that continued or resumed dumping is likely

LPT Coalition and NTC

[41] The LPT coalition and NTC made representations through their responses to the ERQ and a case brief in support of the position that dumping from Korea is likely to continue or resume in the event the present order is rescinded. The parties argued that the measures should remain in place.

[42] The main factors identified by the LPT coalition and NTC can be summarized as follows:

- Korean imports cannot compete at non-dumped prices

- The decreased growth rate in the Korean market is leading to an increased reliance on export markets

- Excess production capacity available to the Korean exporters

- Attractiveness of the transformers market in Canada; and

- Imposition of anti-dumping measures by other countries

Korean imports cannot compete at non-dumped prices

[43] Parties argue that, subsequent to the CITT's injury finding in 2012 concerning large power transformers from Korea, there has been a significant reduction in the volume of imported goods due to the inability by producers to rely on dumped pricing to secure sales as Korean exporters have been unable to compete at the same level in the Canadian market at undumped prices.Footnote 21

[44] The parties further note that even with limited sales to Canada, Korean exporters have resorted to dumping to secure those sales. SIMA Compliance statistics indicate that SIMA duties were assessed in every period of the POR.Footnote 22

[45] The parties presented details regarding specific transactions which suggests that there will likely be significant duty assessments on future subject imports that have yet to appear on the CBSA's compliance statistics and argue that this provides further evidence that Korean exporters cannot secure and ship large orders without dumping.Footnote 23

The decreased growth rate in the Korean market is leading to an increased reliance on export markets

[46] The parties argue that the Korean transformer industry is facing a prolonged market slowdown, resulting in significant excess capacity and that this situation is exacerbated by the Korea Electric Power Corporation's austerity measures following a financial crisis, which led to a loss of approximately C$33 billion.Footnote 24 Parties further indicate that despite these market conditions, Korean transformer producers continue to expand their production capacity, both domestically and in countries like the United States, China, and India. In addition, the parties claim that Korean companies circumvent the anti-dumping order in the United States by serving the market using local subsidiaries thereby worsening the excess capacity issues in Korea. This situation has increased the urgency for Korean producers to find alternative export markets to offload their excess capacity.Footnote 25 The parties point to specific statements made in Hyundai Electric's business plan identifying difficulties in the domestic market and a need to accelerate overseas development.Footnote 26

Excess production capacity available to the Korean exporters

[47] The parties contend that the four known producers of subject goods in Korea, namely Hyundai Electric, Hyosung, Iljin Electric Co., Ltd. (Iljin), and LS Electric Co. Ltd. (LS Electric), have significant and growing excess capacity. The parties provide evidence that Hyosung has 100,000 MVA capacity at its Changwon plant, making it one of the largest power transformer plants in the world. The parties identify discrepancies in the reported production capacity figures provided by Hyundai Electric and claim that the total combined production capacity of the four Korean transformer producers represents several multiples of the Canadian producers' combined capacity.Footnote 27

[48] The parties provide evidence that the four Korean large power transformer (LPT) producers have sufficient excess capacity to replace the entire Canadian industry's sales. Further, the parties provide evidence that the Korean LPT industry's excess capacity is likely to grow even further in the next 24 months due to ongoing investments and market conditions. As an example, the parties indicate that Hyundai Electric has invested approximately $125 million to expand the capacity at its Korean transformer plantFootnote 28 and that other Korean producers have been investing in operations to add or expand capacity. Parties claim that the significant excess capacity in the Korean LPT industry signals a likelihood of continued or resumed dumping.

Attractiveness of the transformers market in Canada

[49] The parties argue that Canada's mature large power transformer market and steady growth would make it an appealing target for dumped Korean goods if the existing anti-dumping order expires. The parties claim that the attractiveness of the Canadian market is due to the sophistication of its large energy utilities, engineering, procurement, and construction firms, and emerging renewable energy projects.Footnote 29

[50] The parties provide evidence that the Canadian market for LPTs has been steady over the POR and that market conditions are likely to remain stable over the medium term. Demand for LPTs in Canada is primarily driven by new transmission or power generation projects and the replacement of existing infrastructure. The parties indicate that while there exists speculation that a sudden spike in LPT demand may occur in Canada to meet its "net zero" targets, they argue that this is unlikely to occur in the short term by providing evidence that suggests that certain provincial electrical systems are deferring large new capacity installation.Footnote 30 The parties indicate that consensus opinion within the industry is that the growth in 2021 and 2022 is explained by the market returning to its pre-2020 levels which were artificially depressed due to market volatility caused by COVID-19 pandemic.Footnote 31

[51] In addition, parties contend that the high price sensitivity of public utilities, the dominant players in the Canadian market, encourages the continuation of dumping by Korean exporters to remain competitive in the Canadian market. Blanket agreements are offered by these major utilities, in which Korean producers are expected to aggressively undercut domestic industry pricing if not constrained by dumping duties. Parties note that many blanket agreements are "open-blankets," where multiple producers compete on price to win units, further incentivizing customers to seek participation of Korean exporters using dumped pricing.Footnote 32

Imposition of anti-dumping measures by other countries

[52] The parties submit that there are several anti-dumping measures in place against Korean LPTs and related goods, demonstrating Korean exporters' tendency to dump, which could result in diversion into the Canadian market if the current order expires. These measures have altered Korean exporters' operations, even leading some to establish local manufacturing facilities in these markets. This not only frees up additional capacity for exports from their Korean plants but also indicates that, if the order expires, Korean exporters are likely to target the Canadian market with renewed intensity.

[53] The parties outline that the World Trade Organization reports the existence of three other anti-dumping measures on LPTs in Argentina, Australia and the United States.Footnote 33 Parties contend that these measures establish a pattern of behavior by Korean exporters, who dump in countries worldwide, as they dumped subject goods into Canada. The parties claim that this behavior is likely to resume should the order expire.

[54] The parties identify the latest administrative review conducted by the US Department of Commerce (USDOC) as further evidence of a demonstrated willingness of Korean exporters to sell LPTs at dumped prices. The USDOC confirmed that all Korean exporters, including Hyundai Electric, Hyosung, Iljin, and LS Electric, have dumping margins of 4.32 percent. The parties contend that the anti-dumping duties imposed on Korean LPTs in the United States have significantly impacted Korean exporters' behavior, with localized production put in place to serve the United States market and "minimize the effect" of anti-dumping duties. Parties argue that by supplying the United States market from United States production, Hyundai Electric has freed up additional capacity in its Korean plant, increasing the likelihood it will resume dumping to Canada should the order expire.Footnote 34

[55] In addition, parties contend that SIMA measures put in place on small power transformers (SPT), of which Hyundai Electric and Iljin are exporters, further demonstrate the aggressive pricing behaviour of Korean exporters and willingness to shift sales to products not subject to dumping disciplines to fill plant capacity and aggressively capture market share. Parties argue that this suggests that if the order on LPTs expires, Korean exporters will likely return to dumping LPTs.Footnote 35

Parties contending that continued or resumed dumping is unlikely

[56] No parties have made representations through their responses to the ERQs, case arguments or reply briefs in support of the position that dumping from Korea is unlikely to continue or resume in the event the present order is rescinded.

Consideration and analysis

[57] In making a determination under paragraph 76.03(7)(a) of SIMA whether the expiry of the order is likely to result in the continuation or resumption of dumping of the goods, the CBSA may consider the factors identified in subsection 37.2(1) of the SIMR, as well as any other factors relevant under the circumstances.

Likelihood of continued or resumed dumping

[58] Guided by the factors in subsection 37.2(1) of the SIMR and having considered the information on the administrative record, the following is a summary of the CBSA's analysis conducted in this expiry review investigation:

- Korean producers are export-oriented, which is likely to continue in the future

- Korean exporters are facing declining sales for power transformers and weak future demand for power transformers in their home market

- Korean producers/exporters have excess production capacity

- Increased competitive price pressure on sales of large power transformers in Canada

- Anti-dumping measures in other countries demonstrate that Korean exporters have a propensity to dump large power transformers

- Measures taken by the United States are likely to cause a diversion of dumped goods into Canada; and

- Anti-dumping duties have been assessed on subject goods imported into Canada during the period of review

[59] As indicated earlier, the CBSA received ERQ responses relating to this expiry review investigation concerning certain liquid dielectric transformers from four Canadian producers (Hitachi, PTI, NTC and Delta Star), two Canadian importers (Hyundai Canada and HE America) and one exporter (Hyundai Electric). The CBSA also received a case brief on behalf of the LPT Coalition.

[60] The CBSA relied on information submitted from these parties, as well as other information on the administrative record for purposes of the expiry review investigation.

[61] Hyundai Electric participated in the original investigation and the subsequent re investigation of the normal values and export prices of certain liquid dielectric transformers from Korea. The continued participation by this exporter, including in this expiry review investigation, suggests they are interested in participating in the Canadian market.

Korean producers are export-oriented, which is likely to continue in the future

[62] As noted by the LPT Coalition, Korean producers of large power transformers are export oriented. Sales data provided by Hyundai Electric confirmed that the company is export oriented and dependent on export markets for sales.

[63] The Middle East is the largest key export market for Hyundai Electric. This is due to the planning and construction of mega-sized new cities within Saudi Arabia and increase in demand for new electrical infrastructure.Footnote 36

[64] In summary, Hyundai Electric is an export-oriented producer that is experiencing increased competition in their traditional export markets, which will bring added competitive pressure on pricing of large power transformers in these markets. As a result, it is likely that the Canadian market will continue to be attractive to the Korean exporters. As such, should the CITT's finding expire, the export-oriented nature of the Korean producers may increase the likelihood of continued or resumed dumping of LPT.

Korean exporters are facing declining sales for power transformers and weak future demand for power transformers in their home market

[65] Evidence on the record indicates a decline in the sales of large power transformers in the Korean domestic market.

[66] The largest purchaser of transformers in Korea is Korea Electric Power Corporation (KEPCO). The Korean domestic market for LPTs is expected to be negatively impacted by KEPCO reporting a record loss of approximately C$33 billion in 2022, largely due to a surge in fuel prices. This loss, the third in the past five years, has prompted KEPCO to initiate an "All-out Efforts to Normalize Management" and a "Financial Reconciliation Plan." KEPCO's plan involves saving approximately KRW 20 trillion over the next five years, with significant portions allocated for project adjustments and cost reduction. These measures involve delaying investments and implementing stringent austerity management. These austerity measures are likely to further dampen the LPT market prospects in Korea.Footnote 37

[67] Based on the foregoing, there is evidence that Hyundai Electric has experienced a decline in domestic sales of large power transformers during the POR. In the near term, it would appear that the Korean market may in fact decline slightly, the result of which will be continued focus by the Korean exporters on export markets, including Canada.

[68] As such, should the CITT's finding expire, the declining domestic market in Korea may increase the likelihood of continued or resumed dumping of LPT.

Korean producers/exporters have excess production capacity

[69] It should be noted that while Hyundai Electric has calculated and reported a theoretical maximum production capacity figure for LPTs, the company brochure indicates that its Ulsan plant has an annual capacity of 120,000 MVA.Footnote 38 The other known producers and exporters of subject goods in Korea; Hyosung, Iljin and LS Electric Hyosung report production capacity of 100,000 MVA, 20,000 MVA and 15,000 MVA respectively.Footnote 39 Hyosung reports divisional capacity utilization for its power unit division at 83% while Iljin reports 80% utilization.Footnote 40 The LPT Coalition demonstrates that, by applying these figures, the estimated combined excess capacity of the four Korean producers could easily supply the entire Canadian market several times over.

[70] Given the exporters' additional excess capacity, in the absence of the CITT's order, there will likely be an increased focus by the Korean exporters to sell into the Canadian market. This may lead to continued or resumed dumping of certain liquid dielectric transformers in the Canadian market in the absence of the CITT's order.

Anti dumping measures in other countries demonstrate that Korean exporters have a propensity to dump large power transformers

[71] On , the USDOC made a final determination of dumping concerning large power transformers from Korea. On , the Argentinian Anti dumping Commission made a final determination of dumping concerning three phased liquid dielectric transformers with power greater than 10 MVA but not exceeding 600 MVA from Korea. Evidence on the record suggests both of these measures remain in force.Footnote 41

[72] The dumping findings by the United States on Korean large power transformers and on a similar range of goods by Argentina, indicate that Korean exporters have a propensity to dump power transformers into export markets. As such, should the CITT's finding expire, the existence of antidumping measures in other countries may increase the likelihood of continued or resumed dumping of LPT.

Measures taken by the United States are likely to cause a diversion of dumped goods into Canada

[73] The imposition of anti-dumping measures by the United States on Korean large power transformers has made it more difficult for the Korean exporters to sell large power transformers into the United States. Specifically, the anti-dumping duties, which were imposed by the USDOC in July, 2012, remain in effect and were updated as recently as .Footnote 42

[74] The imposition of these duties may have contributed to the decision by certain Korean exporters to establish local production capacity in the United States to serve that market. By establishing local production to serve the United States market, Hyundai Electric has increased available capacity in its Korean plant to serve the Canadian market.

[75] Korean LPT producers have excess capacity and are faced with a declining domestic market. There is also increased competitive price pressure on sales of large power transformers in Canada. As such, should the CITT's finding expire, the existence of anti-dumping measures on large power transformers from Korea in the United States may increase the likelihood of continued or resumed dumping of LPT.

Anti-dumping duties have been assessed on subject goods imported into Canada during the period of review

[76] Given the nature of large power transformers in that they are a capital goods built to a customer's specific requirements, there are no domestic sales of like goods in Korea. Therefore, normal values have been determined on a "cost plus" basis pursuant to paragraph 19(b) of SIMA. For enforcement purposes, each cooperative exporter was provided with a spreadsheet to be used to calculate the normal value and export price for each transformer exported to Canada. This spreadsheet contained the factors for selling, general and administrative expenses and an amount for profit, relative to each exporter, to be applied to the full cost of the transformer in order to determine the normal value. HEES and Hyosung, therefore, had the ability to calculate the normal value for each transformer prior to it being shipped to Canada and, had the option to set the selling price at a non-dumped level.

[77] During the POR significant amounts of anti-dumping duties have been assessed on importations of subject goods. Furthermore, amount of anti dumping duty assessed in the first month of 2023 is nearly comparable in scale to the total assessments for the 3 prior years.

[78] As such, should the CITT's finding expire, the assessment of anti-dumping duties on subject goods imported to Canada during the POR may increase the likelihood of continued or resumed dumping of LPT.

Determination regarding likelihood of continued or resumed dumping for Korea

[79] Based on the information on the record in respect of the fact that: Korean producers are export oriented, which is likely to continue in the future; Korean exporters are facing declining sales for large power transformers and weak future demand for power transformers in their home market; Korean producers/exporters have excess production capacity; the increased competitive price pressure on sales of large power transformers in Canada; anti dumping measures in other countries demonstrate that Korean exporters have a propensity to dump large power transformers; measures taken by the United States are likely to cause a diversion of dumped goods into Canada; and Anti-dumping duties have been assessed on subject goods imported into Canada during the period of review; the CBSA determined that the expiry of the order is likely to result in the continuation or resumption of dumping into Canada of certain liquid dielectric transformers originating in or exported from Korea.

Conclusion

[80] For the purpose of making a determination in this expiry review investigation, the CBSA conducted its analysis within the scope of the factors found under subsection 37.2(1) of the SIMR. Based on the foregoing consideration of pertinent factors and an analysis of the evidence on the record, on , the CBSA made a determination pursuant to paragraph 76.03(7)(a) of SIMA that the expiry of the CITT's order made on , in Expiry Review No. RR-2017-002, in respect of the dumping of certain liquid dielectric transformers originating in or exported from Korea, is likely to result in the continuation or resumption of dumping of the goods into Canada.

Future action

[81] On , the CITT commenced its inquiry to determine whether the expiry of the order with respect to the dumping of the goods from Korea is likely to result in injury. The CITT's Expiry Review schedule indicates that it will make its decision by .

[82] If the CITT determines that the expiry of the order with respect to the goods is likely to result in injury, the CITT will make an order continuing the order in respect of those goods, with or without amendment. If this is the case, the CBSA will continue to levy anti-dumping duties on dumped importations of the subject goods.

[83] If the CITT determines that the expiry of the order with respect to the goods is not likely to result in injury, the CITT will make an order rescinding the order in respect of those goods. Anti-dumping duties would then no longer be levied on importations of the subject goods, and any anti-dumping duties paid in respect of goods that were released after the date that the order was scheduled to expire will be returned to the importer.

Information

[84] For further information, please contact the officer listed below:

Mail:

SIMA Registry and Disclosure Unit

Trade and Anti-dumping Programs Directorate

Canada Border Services Agency

100 Metcalfe Street, 11th floor

Ottawa, Ontario K1A 0L8

Canada

- Telephone:

- Hugo Dumas: 343-553-2007

Email: simaregistry-depotlmsi@cbsa-asfc.gc.ca

Doug Band

Director General

Trade and Anti-dumping Programs Directorate

Appendix A

Product information

Power transformers are used to increase, maintain or decrease electric voltage in high voltage transmission and distribution systems. Incomplete power transformers are subassemblies consisting of the active part and any other parts attached to, imported with or invoiced with the active part of the power transformer. The active part of the power transformer consists of one or more of the following when attached to or otherwise assembled with one another: the steel core or shell, the windings, electrical insulation between the windings and/or the mechanical frame for a power transformer.

The product definition encompasses all power transformers regardless of name designation, including but not limited to: step-up transformers, step-down transformers, auto transformers, interconnection transformers, voltage regulator transformers, high voltage direct current transformers and rectifier transformers.

Power transformers are capital goods that are made to order from a customer's specifications based on the customer's particular needs. Power transformers use electromagnetic induction between circuits to increase, decrease or transfer the output voltage levels being transmitted. Induction occurs when the electromagnetic field caused by electricity moving through a conductor crosses a second electrical conductor and generates a voltage in the second conductor even though the two conductors are not directly connected. This requires a fluctuating magnetic field generated by alternating current entering into an input conductor.

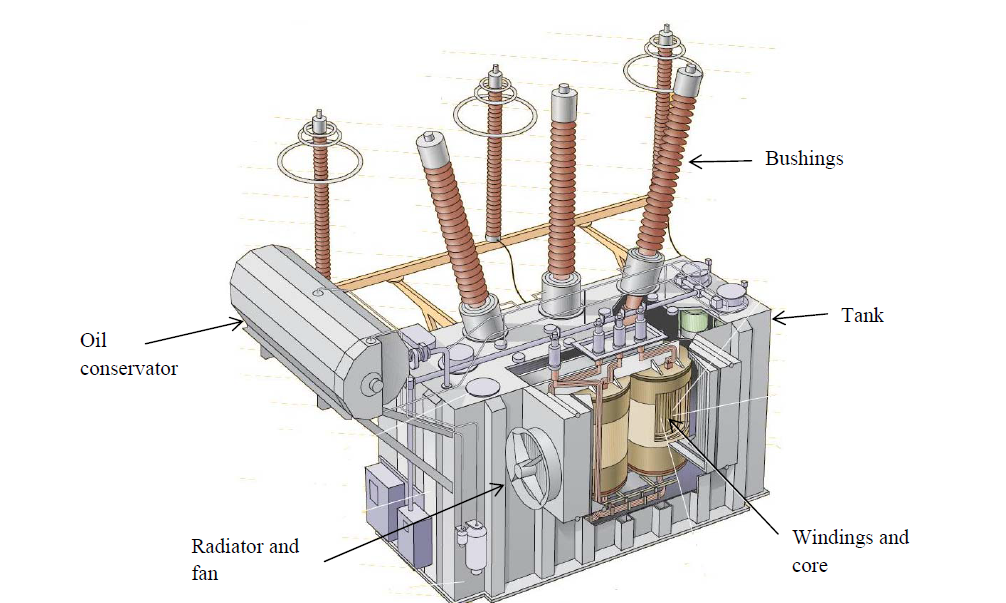

Power transformers all share certain basic, key physical characteristics. All power transformers have at least one active part where the electromagnetic induction occurs. This consists of a core, winding, electrical insulation between the windings and a clamping system to hold the internal assembly together. The internal assembly is placed into a metal tank that is filled with a cooling media and has a cooling system attached. A diagram showing the major components of a power transformer follows:

Major components of a power transformer

The core is made of silicon steel and is laminated with an inorganic coating. The silicon steel is layered in pieces and shaped into the legs and yokes of the core. Cores typically consist of two, three, four or five legs depending on the number of phases, capacity and transport restrictions.

Upon the core are windings made of copper conductor covered in insulation paper and/or enamel coating to insulate the turns from one another. They provide both electrical power input and output. There are typically windings for each voltage level and there can also be one or more windings for voltage regulation. Winding can be done through layer winding, helical winding, disc winding or interleaved disc winding. The winding method employed depends on the capacity, voltage and tap range of each power transformer as specified by the customer.

The core and winding are placed in a tank, which protects the active parts of the power transformer. The tank must be strong enough to withstand an internal pressure of a full vacuum and external factors such as weather. The tank is usually filled with fluid (typically oil) for cooling and insulation. The size of the tank varies depending on the size of the core, number of windings and type of regulation, which itself is a function of the energy being transformed and customer specification.

All power transformers have a cooling system which ensures that heat is dissipated and prevents exceeding the specified temperature rise in the power transformer. The cooling method is determined by the customer's requirements and use. Power transformers can employ several different cooling systems including: natural oil cooling/natural air cooling, natural oil cooling/forced air cooling, forced oil cooling/forced air cooling, directed oil cooling/forced air cooling and forced oil cooling/forced water cooling.

- Date modified: